According to the the AMA website their group disability plan is designed specifically for physicians providing them with completely portable, own-specialty disability coverage at a significant discount for AMA members.

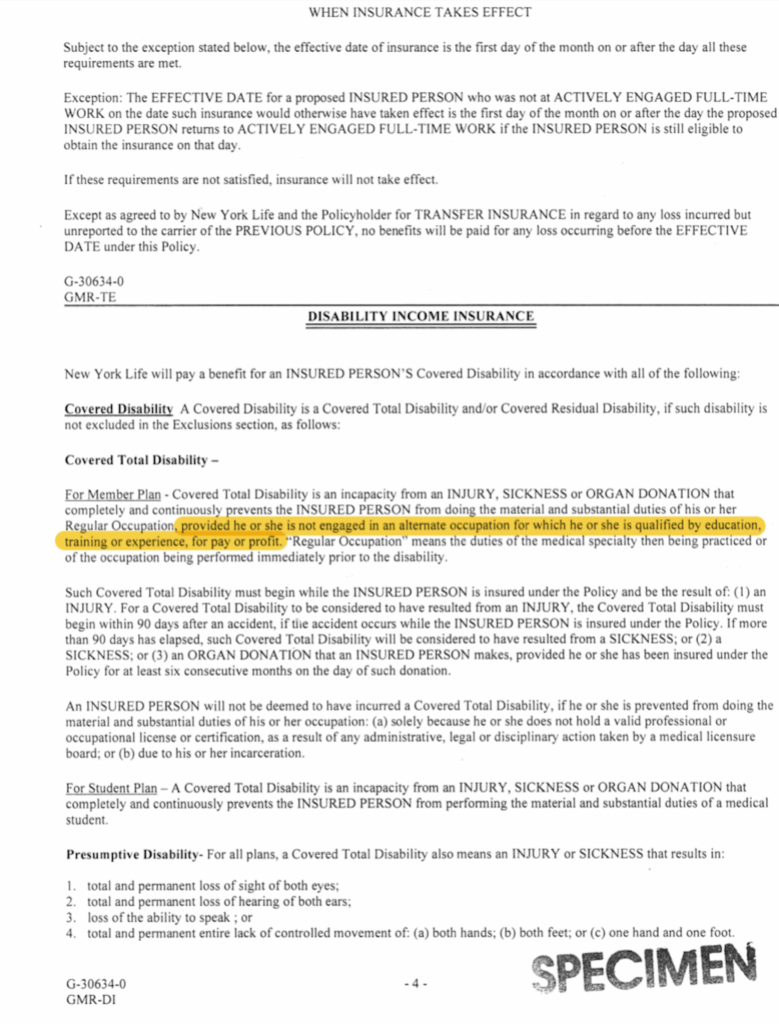

The AMA defines their policy as an “Own-Specialty” plan that “contains a preferred definition of disability, called ‘own-specialty.’ this means you are eligible to receive benefits if you’re unable to perform the duties of your own medical specialty – even if you have the ability to work in another field of medicine.

There is a significant difference between having the “ABILITY” to work in another occupation and “Choosing” to work in another occupation.

Physicians should be aware that the term “Own-Specialty” means a disability policy that “allows” you to continue to work in another occupation. A “True” “Own-Specialty” disability policy will continue to pay you your full Disability Income regardless of how much income you may earn working in another occupation.

With a “True” Own-Specialty disability policy, suffering a disability that prevents you from working in your medical specialty does not have to be a death sentence on your career. You can engage in other activities with the potential to earn an income without the risk of eliminating the disability coverage you are receiving.

Only 7 carriers offer physicians “True” Own-Specialty disability and the AMA is not one of them. Ameritas, Guardian, MassMutual, Mutual of Omaha, Ohio National, Principal, and The Standard.

As an example, Guardian defines “True” Own-Specialty disability insurance as a policy that due to injury or sickness, pays your full disability benefit if you are not able to perform the duties of your occupation.

As an example, a surgeon who becomes disabled and can no longer use their hands to perform surgery but elects to work in another occupation or medical specialty would still qualify for their full disability benefit.

Unfortunately, many physicians have fallen victim to the plan offered through the AMA often realizing the policy limitations at a point where it is too late to correct the mistake.

We’ve attached a copy of the AMA sponsored NY Life Disability plan below and highlighted the contractual definition of Total Disability.

Additional AMA Disability Contract Concerns

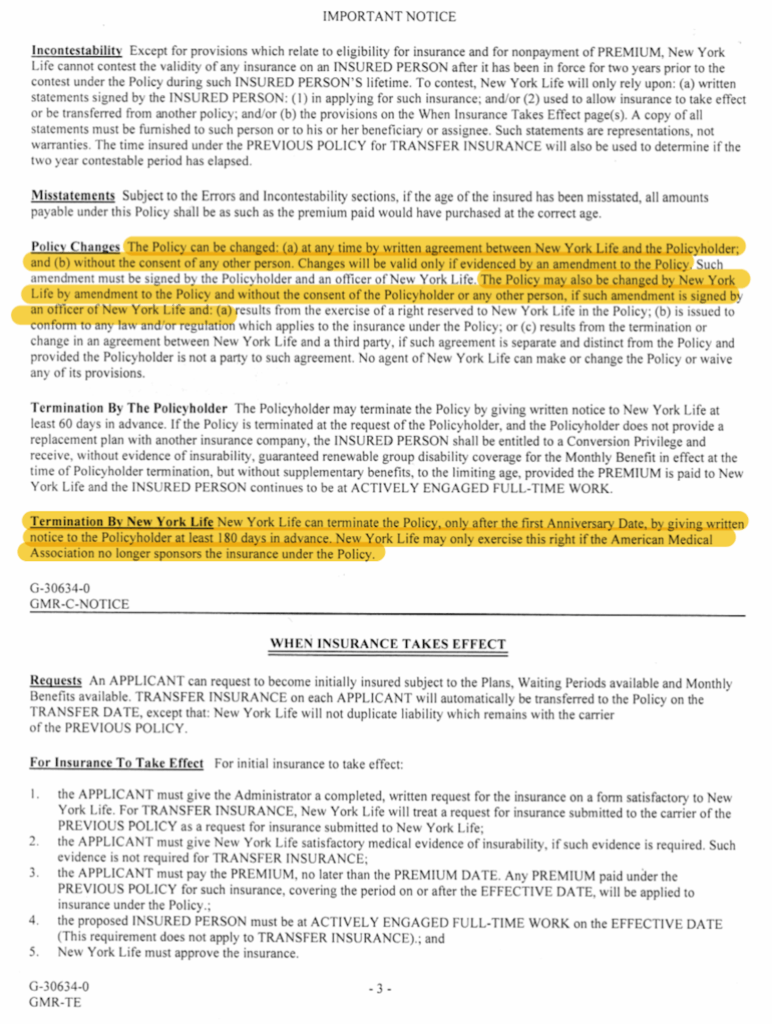

- Premiums will increase every 5 years

- Premiums can increase at any time

- Contract features and provisions are not guaranteed

- Before you are eligible to receive your benefit, you must first be disabled for up to 90 days of consecutive missed days.

- The contract can be terminated by NY Life at any point in time in the future

- You must continue paying your AMA annual dues in order to receive discounted premium

True Own Specialty Plans

- Allow you to work in another occupation while allowing you to continue to collect your full disability benefit

- Premiums are guaranteed

- Contract provisions are guaranteed

- The contract cannot be terminated by the carrier

- Your waiting period can be an accumulated of missed days

Physicians understand that the phrase “Own-Specialty” refers to a disability policy that provides them a tax-free income should a sickness or injury prevents them from working within their medical specialty while allowing them to work in another occupation.

The AMA falsely refers to their contract as “Own-Specialty” because their plan pays your full benefit should a sickness or injury prevent you from working within your medical specialty even if you have the <span><strong>”ABILITY”</strong></span> to work in another occupation, but will not consider you Totally Disabled if you elect to work in another occupation. A policy that limits your ability to work in another occupation is not considered “True” Own-Specialty disability insurance.

As a physician, you should feel confident that the plan you purchase will cover you for what you understand an “Own-Specialty” disability policy to stand for, and that’s the ability to earn an income in another occupation even if a disability prevents you from working in your current medical specialty.

800-538-3767

800-538-3767