Own Occupation Disability Insurance

Own Occupation Disability insurance is invaluable to physicians, however, there are 3 tiers of coverage that exist. Learn how to distinguish between each tier and choose the coverage that’s best for you.

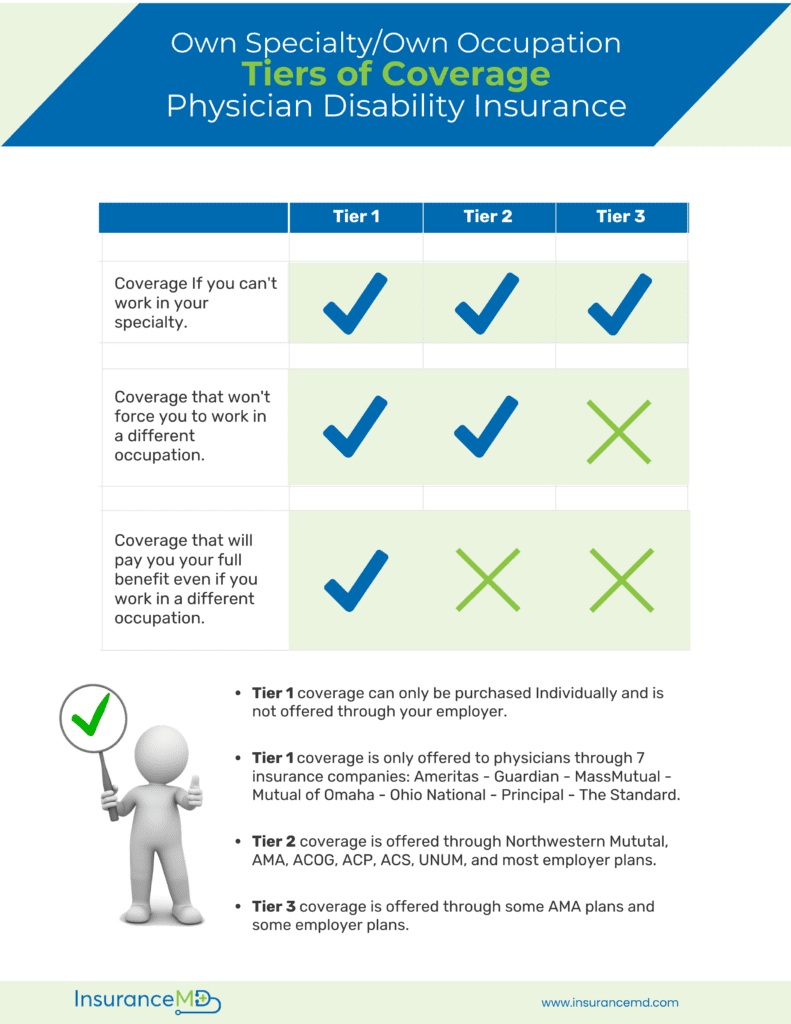

In the insurance industry, the phrase ‘Own Occupation’ or ‘ Own Specialty’ is separated into three categories. Physicians often end up with incorrect policy because someone told them their plan was Own Occupation without properly disclosing that there are in fact 3 different tiers of Own Occupation coverage. This article is intended to make you aware of the different levels of Own Occupation Coverage so you can pick the type of plan that best fits your needs.

Definition of Total Disability

The most critical part of your disability plan is the Definition for Total Disability. This establishes when you are eligible to receive your full benefit. This definition defines which tier of Own Occupation/Own Specialty coverage you have.

Tier 3 Coverage

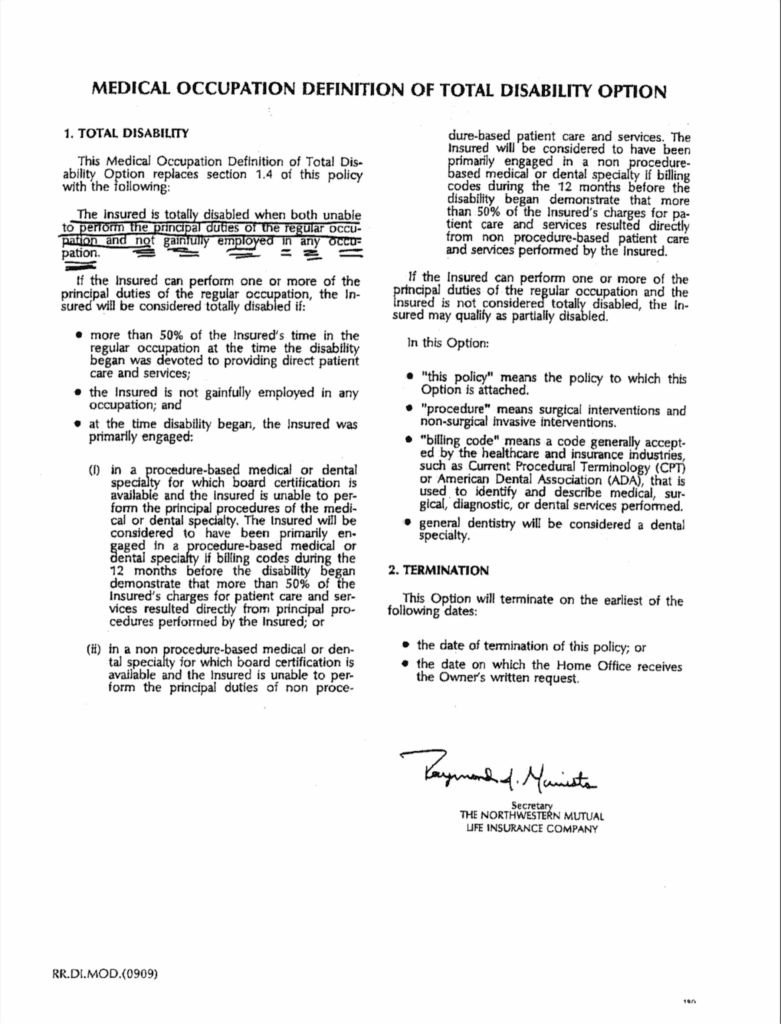

Tier 3, provides a replacement of income if you cannot work in your medical specialty. However, the insurance carrier has a clause that allows them to judge if they feel you can continue working based on your education, training or experience. This can include occupations that the insurance carrier feels you may be capable of engaging in even with your disability.

Tier 3 coverage is the least favorable disability option for physicians. It allows the insurance company to determine the future of your career. Tier 3 Own Occupation Coverage is offered through some employer plans and through certain AMA and other professional association plans.

Tier 3 Example (Employer Long Term Plan)

Tier 2 Coverage

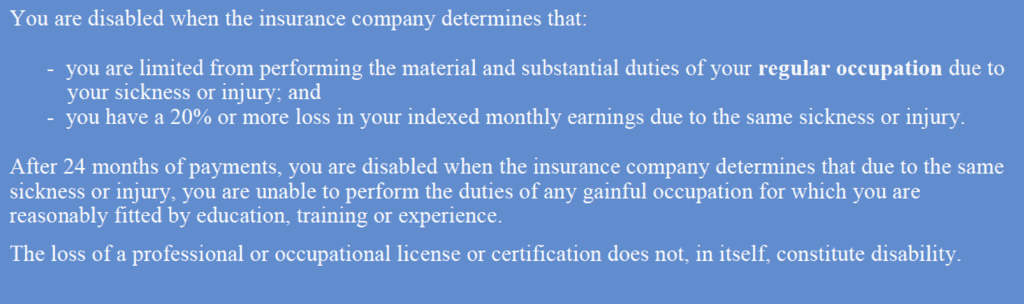

Tier 2 coverage replaces your income if you cannot work in your medical specialty. With Tier 2 Own Occupation coverage, the insurance carrier does not have the power to force you into a different occupation. However, if you elect to pursue another occupation, then your disability benefit will be reduced or eliminated based on your income from your new occupation.

Tier 2 coverage limits you from being able to continue your career in another occupation. Most physicians will try to work even if a disability prevents them from performing the duties of their medical specialty. Tier 2 coverage is more favorable than Tier 3 coverage, however, Tier 2 coverage still hinders your ability to remain in full control of your financial future. Tier 2 Own Occupation Coverage is offered through most employer plans and Northwestern Mutual, UNUM, SunLife, ACOG, ACS, ACP, AAP, and the AMA. Some companies that provide Tier 1 benefits also provide Tier 2 benefits: Principal, MetLife, MassMutual, and The Standard, so if you have a plan from one of these carriers it is important that you check your definition of Total Disability.

Tier 2 Example (NorthWestern Mutual)

Tier 2 Example (AMA)

Tier 1 Coverage

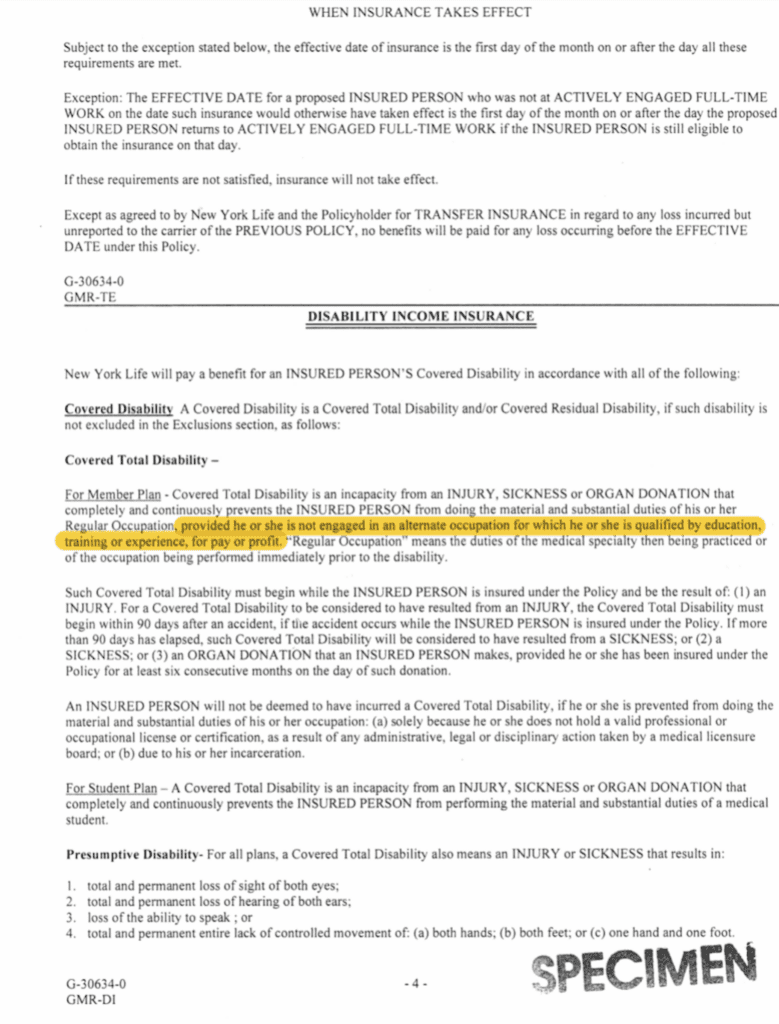

Tier 1 coverage is the best Own Occupation coverage for physicians. Tier 1 Own Occupation coverage provides full coverage for physicians who are unable to work in their medical specialty. The insurance carrier does not have the power to force you into another occupation and they will never reduce or eliminate your coverage even if you elect to work in a different occupation, regardless of how much income you may earn.

When a physician says they want Own Occupation/Own Specialty disability insurance, they are referring to Tier 1 Coverage. Tier 1 coverage offers you the ability to replace your income if a sickness or injury prevents you from working in your medical specialty. Tier 1 coverage allows you to remain control of your career without penalizing you for earning another income. Tier 1 Own Occupation coverage can only be purchased privately, it is not offered through your employer. Only 7 insurance carriers offer this coverage to physicians:

Ameritas – Guardian – MassMutual – Mutual of Omaha – Ohio National – Principal – & The Standard.

At InsuranceMD, we shop the rates from all 7 insurance carriers that offer physicians Tier 1 Own Occupation Coverage. What you pay for coverage isn’t impacted by which agent you work with. Certain carriers offer discounts based off of hospital affiliations or professional association affiliations. Contact an InsuranceMD agent to see if you may qualify.

“Tier 1” Own Occupation Disability Quote Request

Tier 1 Example (Guardian)

800-538-3767

800-538-3767