As a physician affiliated with Montefiore, you are likely participating in the Group Long Term Disability plan. I am writing this letter to make you aware of the significant limitations inside our plan which may leave us exposed if we were to suffer a disability.

I was recently introduced to InsuranceMD through a colleague of ours who was adamant I speak with them about Long Term Disability Insurance. The agent I spoke with tried to educate me on the importance of having Own Specialty Disability Insurance, but i was convinced I had adequate disability coverage as an employed physician of Montefiore. He then took the time to actually provide me with a complete review of our Montefiore Long Term Disability benefit and what I learned shocked me and that is why i’m taking this opportunity to share what I learned with you:

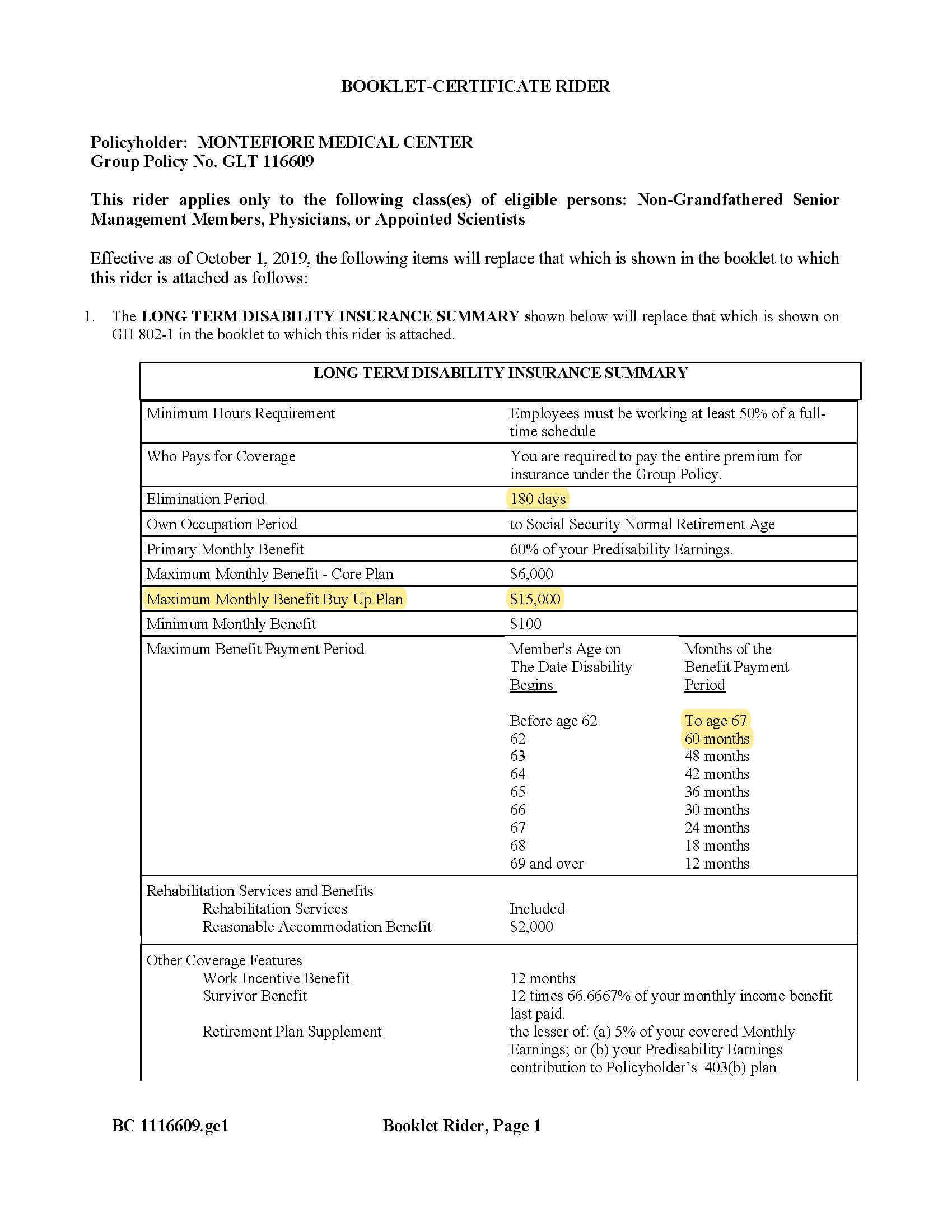

- Only $6,000 per month of coverageOur Montefiore plan only provides us with coverage of 60% of our base income up to cap of $6,000 per month based in coverage. If we elect to pay for the buy-up plan, that cap increases to $15,000 per month.

- Our coverage is “NOT” True OccupationOur coverage is only paid to us in full if we are disabled in our specialty but we are not working in any other occupation for wage or profit.

- Social Security payments count against usIf we become disabled and we are working in another occupation, our benefits will be reduced. If we are disabled and we are receiving Social Security Benefits, the benefit will also be reduced.

- Work related injuries may not be coveredOur group policy contains a workers compensation clause that states if our disability is caused by a work related injury or sickness, that our benefits may not be payable under this policy if we are eligible for workers compensation.

- Only 24 months of coverage for mental healthIf a disability results from a Mental Health Condition, the maximum number of months we may be eligible to receive benefits for is 24 months.

- Our coverage is “not” portableIf we leave Montefiore, our plans stays behind. This means if we try to obtain coverage privately or through another employer, we may not be eligible based on any pre-existing medical conditions.

- Pre-existing conditions are treated differentlyIf a disability occurs within the first 12 months of signing up with the plan, we will need to wait 12 months before we are eligible to receive any coverage.

Our Montefiore Disability is Not Own Specialty Coverage

As you can see from above, our Montefiore coverage is not adequate for me. I’ve been taught that as a physician, I need Own Specialty Disability Insurance. Our Montefiore policy refuses to pay us our full benefit if we elect to work in any other occupation. As physicians, we need a plan that will protect us from a sickness or injury that may disable us from working in our specialty without reducing our benefits if we elect to continue our careers in a different occupation. Our policy should also protect our full income, not just the income we earn as a base salary. Because of these limitations I opted to purchase a supplemental individual Own Specialty policy.

Below is a copy of our Montefiore plan information.

As physicians we need “True” Own Specialty Protection.

We should have coverage that provides us with “Tax-Free” income should “any” sickness or injury prevent us from working in our medical speciality. That benefit should allow us to earn income in another occupation without reducing our benefits.

Our disability plan should provide us income protection for both our base and bonus income. Since our health can change as we get older, it’s imperative that our coverage is guaranteed. This means if we leave Montefiore our coverage comes with us until we decide we no longer need the protection. Although this coverage comes with a price, the cost of not having it far exceeds what we will pay.

Please take a moment to fill out the form below to speak with the agent who has helped me and others affiliated with Montefiore to in obtain your own “True” Specialty Coverage.

Thank you,

Dr. Emily S

800-538-3767

800-538-3767