In the complex world of disability insurance, physicians often find themselves navigating through a maze of terms and definitions that can significantly impact their financial security. Recent trends have shown that some insurance providers, such as the AMA and Northwestern Mutual, are using phrases like “Own Specialty” and “Medical Occupation” in their policies. While these terms may sound reassuring, they can be misleading. It’s crucial for doctors to understand the true implications of these definitions and ensure they are fully protected.

Key Takeaways for “Own Specialty” and “Own Occupation” Disability Insurance: Don’t Be Misled by these Misleading Terms

- Understanding Misleading Terms:

- Physicians often use terms like “Own Specialty” and “Own Occupation” to describe policies that provide income replacement if they cannot work in their medical specialty.

- Some insurance providers, such as AMA and Northwestern Mutual, misuse these terms to market products that do not offer true comprehensive coverage.

- Evidence of Misleading Practices:

- Insurance companies may label their policies with reassuring terms, but the actual coverage may not meet the expectations set by those labels.

- Examples from AMA and Northwestern Mutual show policies that restrict benefits if a physician works in another occupation.

- True Definition of Total Disability:

- Genuine “Absolute Physician Income Protection” policies ensure full income protection if a physician cannot perform their medical specialty, regardless of income from other sources.

- Companies like Ameritas, Guardian, MassMutual, Mutual of Omaha, Principal, and The Standard offer true “Own Specialty” policies.

- Key Features of True Own Specialty Policies:

- Full Income Protection: These policies pay the full disability benefit even if the physician works in another field.

- No Income Restrictions: Benefits are not reduced based on other income sources.

- Clear Definitions: Transparent terms and conditions ensure physicians understand their coverage.

- Importance of Accurate Coverage:

- Physicians need to protect their ability to earn income in their medical specialty, their most valuable asset.

- Misleading insurance terms can jeopardize financial security; it’s crucial to have the right insurance that truly covers the physician’s needs.

- Conclusion:

- Physicians should avoid being misled by marketing tactics and understand the true definitions and limitations of their disability insurance policies.

- Consulting with experts like InsuranceMD can help navigate these complexities and ensure comprehensive protection.

Understanding the Misleading Terms

Doctors have coined terms like “Own Specialty” and “Own Occupation” as shorthand for a specific type of disability policy. These policies are supposed to pay an income replacement if a physician cannot work in their medical specialty and still allow them to collect their full benefit even if they work in a different occupation. However, some insurance companies have co-opted these terms to market products that do not meet these criteria.

Insurance companies like the AMA and Northwestern Mutual have coined terms like “Own Specialty” and “Medical Occupation” to define their disability insurance products. These terms give the impression that physicians can continue to earn an income from another occupation while still collecting their full disability benefits. However, this is not the case.

Evidence of Misleading Terms

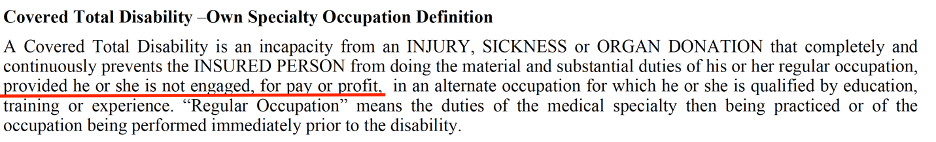

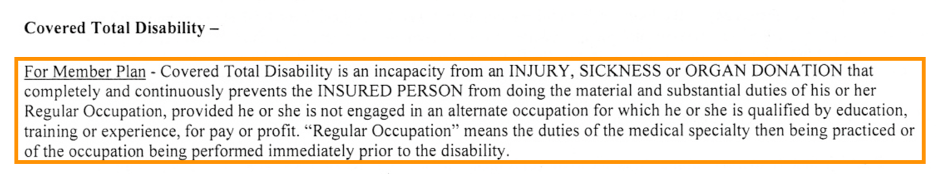

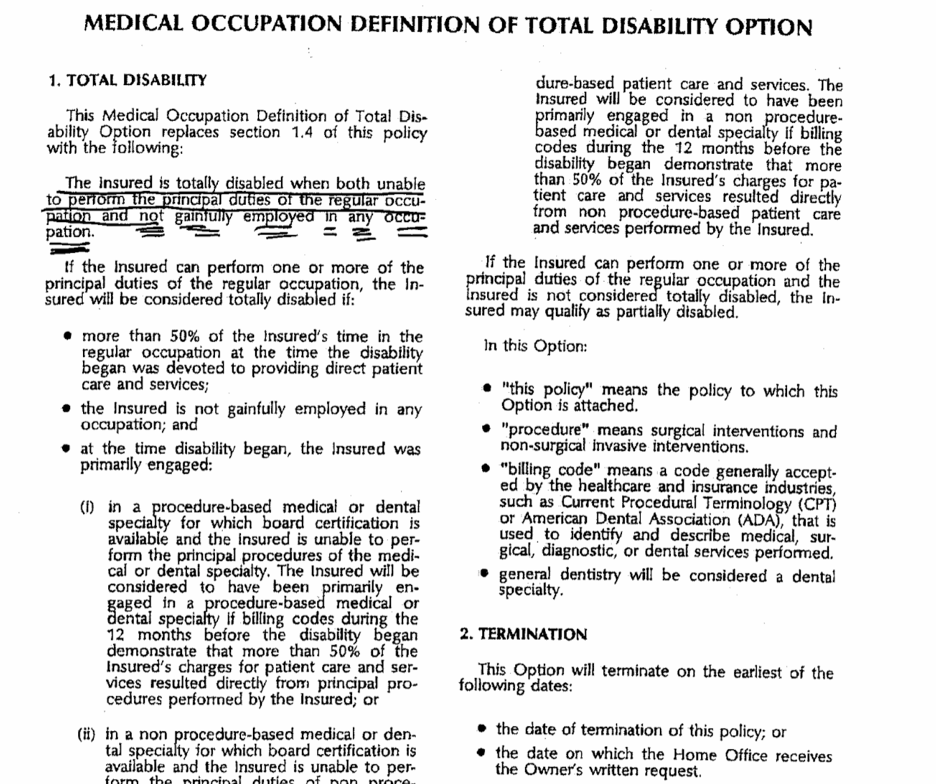

Below are screenshots of the new AMA plan, the old AMA plan, and the Northwestern Mutual plan. These screenshots illustrate how these companies use terms like “Own Specialty” and “Medical Occupation” to create an impression of comprehensive coverage that does not actually meet the criteria set by physicians.

The AMA recently released a new product through NY Life that they market as True “Own Specialty Occupation Definition.”

However, when you compare this definition of Total Disability to that of their previous product you will notice that they only changed the name of Covered Total Disability to include the words “Own Specialty Occupation Definition.”

So, what’s changed? Nothing. The limitation remains the same: if you choose to work in a different occupation, your coverage is restricted. They have merely added the words “Own Specialty Occupation Definition” to capitalize on the phrase doctors use to describe a more comprehensive protection plan, which they are not actually offering.

Northwestern Mutual has employed similar marketing tactics by creating a phrase that leads physicians to believe they have the appropriate coverage. They call it the “Medical Occupation Definition of Total Disability.” However, this definition still restricts physicians from being engaged in another occupation and collecting their full benefit. See below.

The Definition of Total Disability

To safeguard your financial future, it is imperative to choose a policy that provides genuine “Absolute Physician Income Protection.” This type of policy ensures that you can still earn an income from another occupation without affecting your disability benefits. Companies such as Ameritas, Guardian, MassMutual, Mutual of Omaha, Principal, and The Standard offer policies that adhere to this true definition.

How an Absolute Physician Income Protection Policy Works:

- Full Income Protection: These policies allow you to receive your full disability benefit if you cannot perform the duties of your medical specialty, even if you work in another field.

- No Income Restrictions: Unlike misleading policies, Absolute Physician Income Protection insurance does not reduce your benefits based on income from other sources.

- Clear Definitions: The terms and conditions are straightforward, ensuring that you understand your coverage and can rely on it when needed.

Why Absolute Physician Income Protection Coverage Matters

As a physician, your ability to earn an income is your most valuable asset. To avoid falling victim to misleading phrases like “Own Specialty,” “Own Occupation,” and “Medical Occupation,” it’s crucial to understand the true definitions and limitations of these terms. It’s not just about having insurance; it’s about having the right insurance that genuinely covers your needs.

Conclusion

Don’t be misled by catchy phrases and marketing tactics. Understanding the true definition of disability insurance terms can make a significant difference in your financial security. Always read the fine print and consult with an expert like the physician specialists at Insurance MD, who can help you navigate the complexities of disability insurance.

If you have any questions or need further clarification on your policy, feel free to reach out. Your financial well-being is too important to leave to chance.

FAQs for “Own Specialty” and “Own Occupation” Disability Insurance: Don’t Be Misled by these Misleading Terms

Q1: What do “Own Specialty” and “Own Occupation” disability insurance terms mean?

A1: “Own Specialty” and “Own Occupation” disability insurance terms refer to policies that provide income replacement if a physician cannot work in their specific medical specialty due to disability. These policies are designed to allow physicians to collect their full benefit even if they choose to work in another occupation.

Q2: Why are these terms considered misleading by some insurance providers?

A2: Some insurance providers, such as the AMA and Northwestern Mutual, use these terms in their marketing to give the impression of comprehensive coverage. However, their policies may not meet the criteria expected by physicians, often restricting benefits if the physician works in another occupation.

Q3: What is the true definition of “Total Disability” in the context of disability insurance?

A3: The true definition of “Total Disability” in the context of genuine “Own Specialty” policies ensures that physicians receive full income protection if they cannot perform the duties of their medical specialty, even if they work in another field. These policies do not reduce benefits based on income from other sources.

Q4: Which companies offer genuine “Own Specialty” disability insurance?

A4: Companies such as Ameritas, Guardian, MassMutual, Mutual of Omaha, Principal, and The Standard offer policies that provide true “Own Specialty” disability insurance, ensuring comprehensive coverage and financial protection for physicians.

Q5: What are the key features of true “Own Specialty” disability policies?

A5: The key features include:

- Full Income Protection: Pays the full disability benefit if unable to perform the medical specialty, even if working in another occupation.

- No Income Restrictions: Benefits are not reduced based on other income sources.

- Clear Definitions: Transparent terms and conditions to ensure physicians understand their coverage.

Q6: How can misleading terms affect a physician’s financial security?

A6: Misleading terms can create a false sense of security, leading physicians to believe they have comprehensive coverage when they do not. This can result in reduced benefits or denied claims, jeopardizing their financial security during a disability.

Q7: Why is it important for physicians to have accurate disability insurance coverage?

A7: Accurate disability insurance coverage is crucial because it protects the physician’s ability to earn an income in their medical specialty, which is their most valuable asset. Without proper coverage, a physician’s financial stability and career could be at significant risk in the event of a disability.

Q8: How can physicians ensure they have the right disability insurance coverage?

A8: Physicians can ensure they have the right disability insurance coverage by:

- Understanding the true definitions and limitations of policy terms.

- Consulting with experts, such as those at InsuranceMD, who specialize in physician disability insurance.

- Choosing policies from reputable companies that offer genuine “Own Specialty” coverage.

Q9: What should physicians do if they have questions about their disability insurance policy?

A9: Physicians should reach out to experts or their insurance provider for clarification. Consulting with specialized agencies like InsuranceMD can provide detailed guidance and help physicians navigate the complexities of disability insurance to ensure they have the right protection.

Q10: How can physicians avoid being misled by marketing tactics in disability insurance?

A10: Physicians can avoid being misled by:

- Reading the fine print of their policies.

- Seeking advice from insurance specialists who understand the unique needs of medical professionals.

- Comparing different policies and providers to ensure they get comprehensive and accurate coverage.

800-538-3767

800-538-3767