Own Occupation Disability Insurance is Expensive

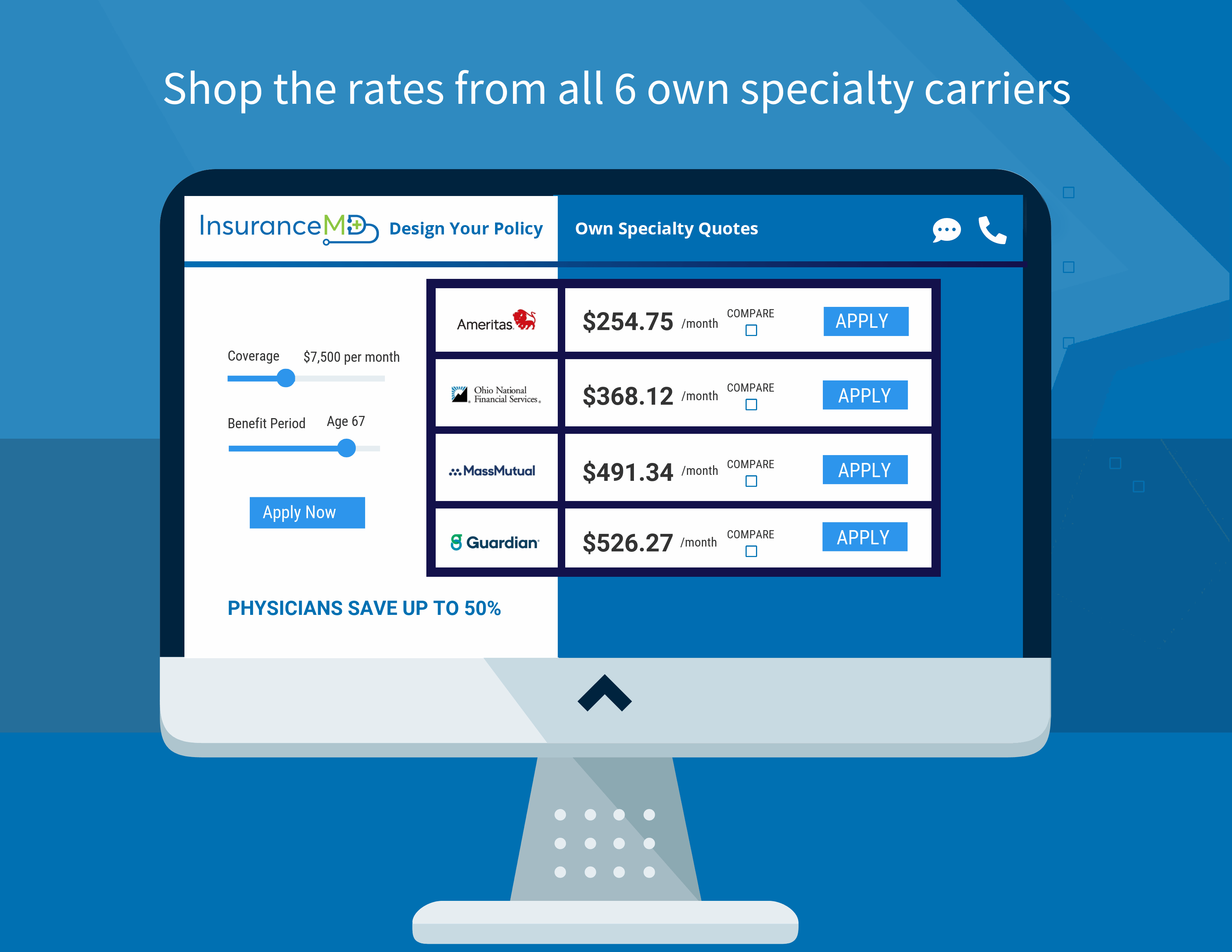

Only 6 carriers offer Physicians Own Specialty/Own Occupation Disability Insurance

Ameritas – Guardian – MassMutual – Ohio National – Principal – The Standard

If you are looking for disability insurance for the first time, It’s not easy to find a Disability Broker who understands the importance of owning the Own Specialty Disability Insurance. Through our years of working with White Coat Physicians, we’ve noticed that the majority of Physicians who come to us looking for advice after having already met with another disability broker have only been quoted between 1 and 3 of the above Own Specialty Disability carriers.

Why?

The Truth is, it’s hard for an agent to maintain appointments with more than just a couple of disability carriers. Disability Carriers want to work with agents who are going to produce business by selling their products. Often setting production quotas for agents. These production quotas control the percentage the agent is commissioned for a sale as well as the agent’s ability to maintain their appointment to sell products for the carrier. With only a few million physicians in the United States, the market for selling disability insurance is very small which makes it very difficult for an agent to submit enough business to each carrier. This results in the majority of brokers only presenting to their physician clients the carriers they have the strongest relationship with.

If you’ve ever met with one of these brokers, You may have noticed your broker had made statements suggesting that one carrier is stronger or better than another at paying claims. This just isn’t true. The facts are that the above carriers pay claims without hassle for qualifying disabilities, but sadly brokers often need us to think otherwise in order to drive more business to a carrier that might not be the best option for you based on price.

We don’t necessarily blame the brokers for this, we blame the carriers. Carriers don’t want to compete on price – so they do everything in their power to work with Agents/Brokers who will push their product regardless of cost.

Even here at White Coat Insurance Group, we show our clients a quote from every carrier side by side. Our willingness to do this has resulted in some of the above-named Insurance carriers going as far as to demand we cease and desist showing the physician consumer all the available disability options side by side.

We are strong advocates for the purchase of Own Specialty/Own Occupation Disability insurance to our physician clients. We recognize that 6 carriers offer an excellent Own Specialty Disability Product. We also are aware that some carriers are priced better than others for a definition of Own Specialty that is exactly the same, so what’s wrong with showing our clients all 6 of them so you can make an educated decision on what’s best for you? Nothing!

The Best Way for a physician to save money on Disability Insurance is to shop for quotes from all 6 carriers and compare them side by side.

Make sure you work with an agency like ours that will quote you all the available options from the 6 different carriers who offer Own Specialty Disability Insurance. Just through shopping, our clients save about 30% a year on their premiums for life.

Discounts may be available from certain carriers based on Hospital affiliations or professional association affiliations. Make sure you let your agent know about your affiliations in order to maximize your savings.

Disability Insurance is a product you will be paying for throughout your entire career and the cost may seem expensive. Work with an Agency like ours who will shop the rates and discounts from all the available carriers to ensure you are getting the best value for your money.

Remember, the cost of not owning disability insurance is far more expensive than paying for it. Let us help you compare all the options and show you how to save up to 50% a year on your premiums just through shopping.

800-538-3767

800-538-3767