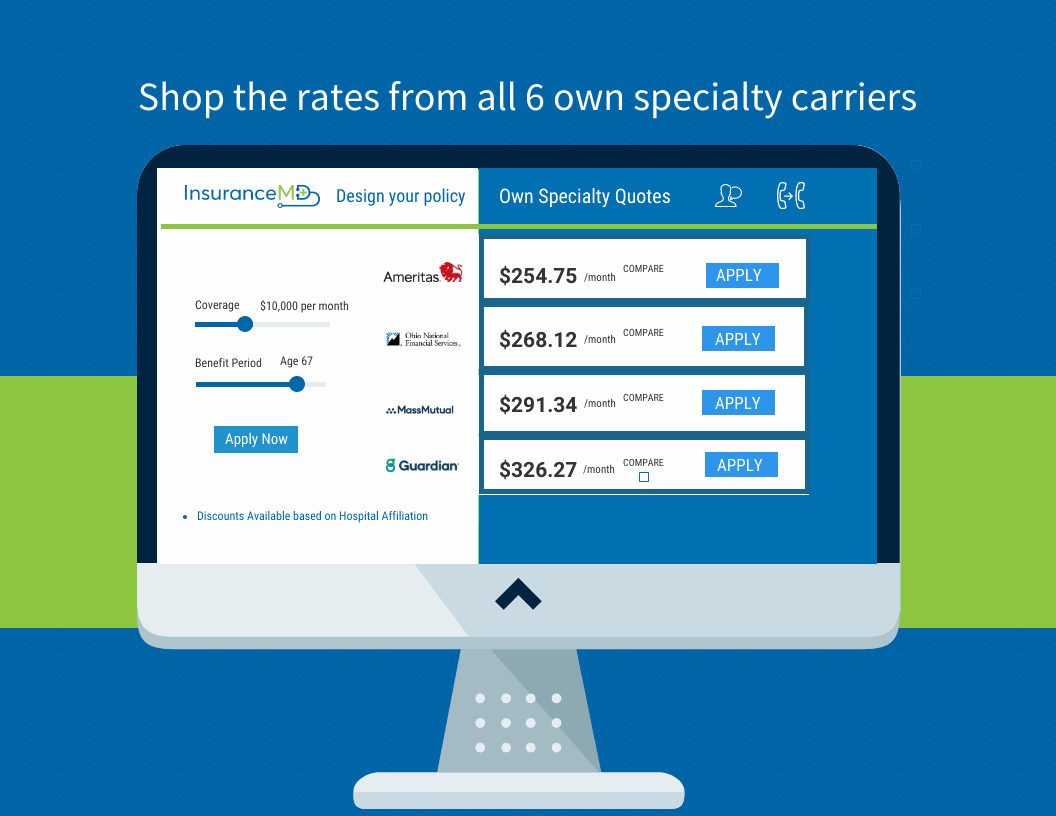

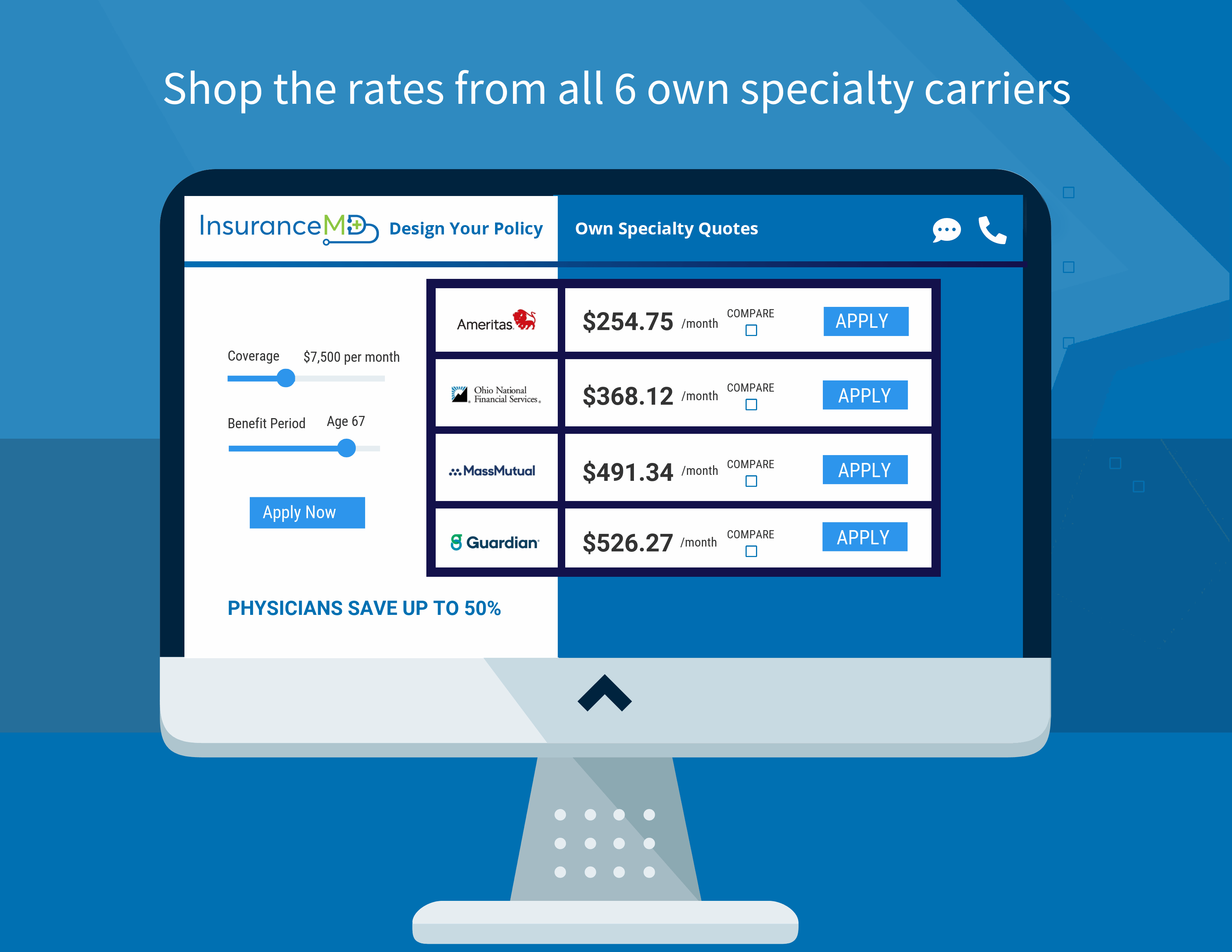

Every week we run hundreds of quotes for physicians who are looking to compare the rates from carriers that offer True Own Specialty Disability Insurance.

Once you are convinced that owning Own Specialty Disability Insurance is essential to your financial wellbeing – the first question you are going to want us to answer for you is “what does it cost?”

So we decided to answer your #1 question by posting some of the quotes we ran throughout the week for physicians just like you who wanted to know just how much Own Specialty Disability Insurance would cost them.

Everyone’s quote is different based on the following factors:

- Your Age

- Your Sex

- Your Medical Specialty

- Your Health History

- The benefit amount you qualify for based on your income and other in-force coverage

- The riders you choose

- Discounts you may be eligible for based on affiliations

Currently, only six have a policy that provides True Own Specialty Disability Insurance to Physicians

Some Quotes from the Week of March 2nd, 2020

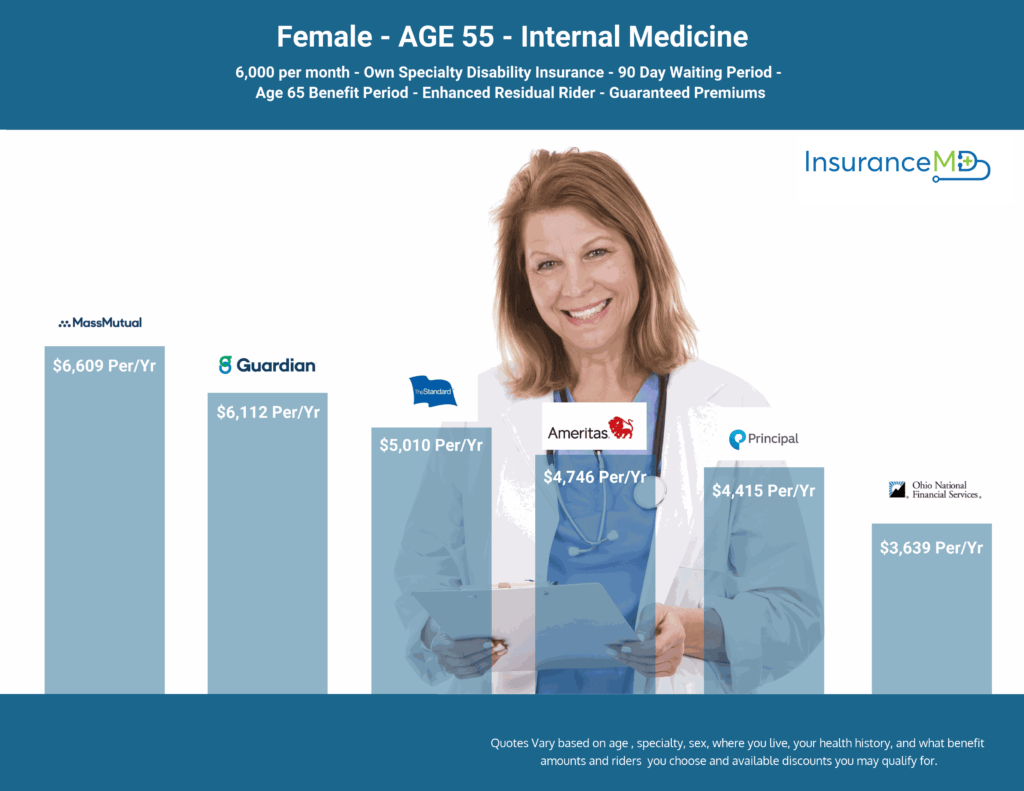

Female – Internal Medicine – 55 Years Old – $6,000 Per Month Own Specialty Benefit – 90 Day Elimination Period –

Age 65 Benefit Period – Enhanced Residual Rider – Noncancellable/Guaranteed Renewable

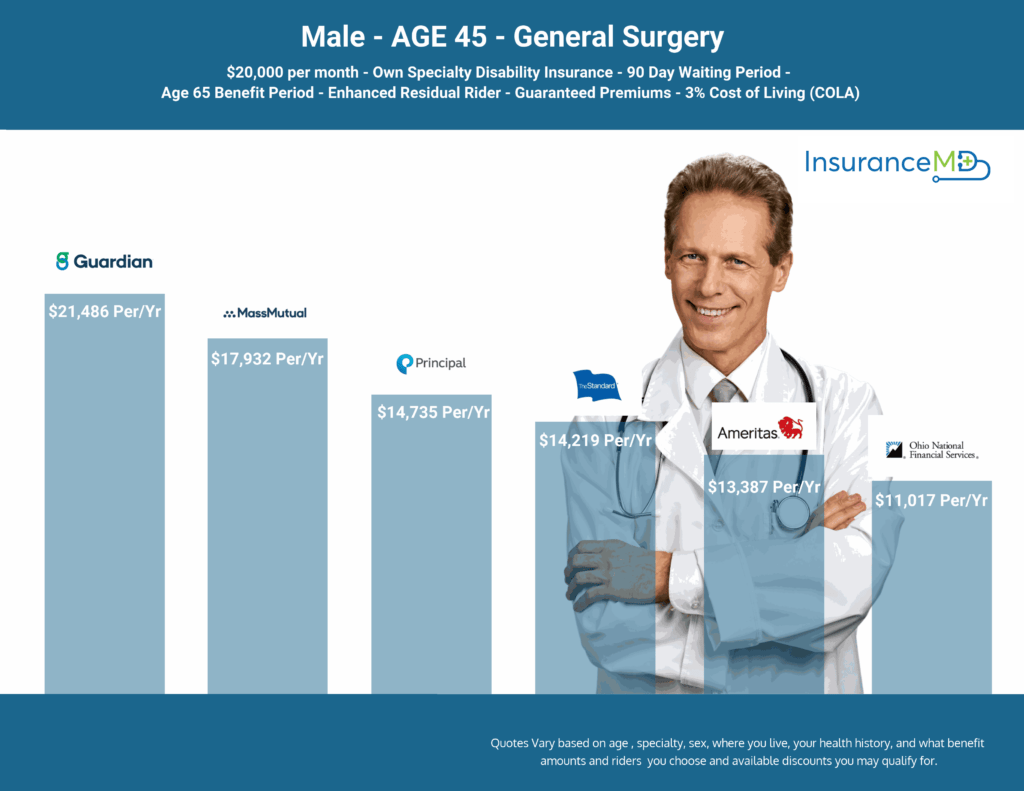

Male General Surgeon – 45 Years Old – $20,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 65 Benefit Period – Enhanced Residual Rider – 3% Cost of Living Adjustment Rider – Noncancellable/Guaranteed Renewable

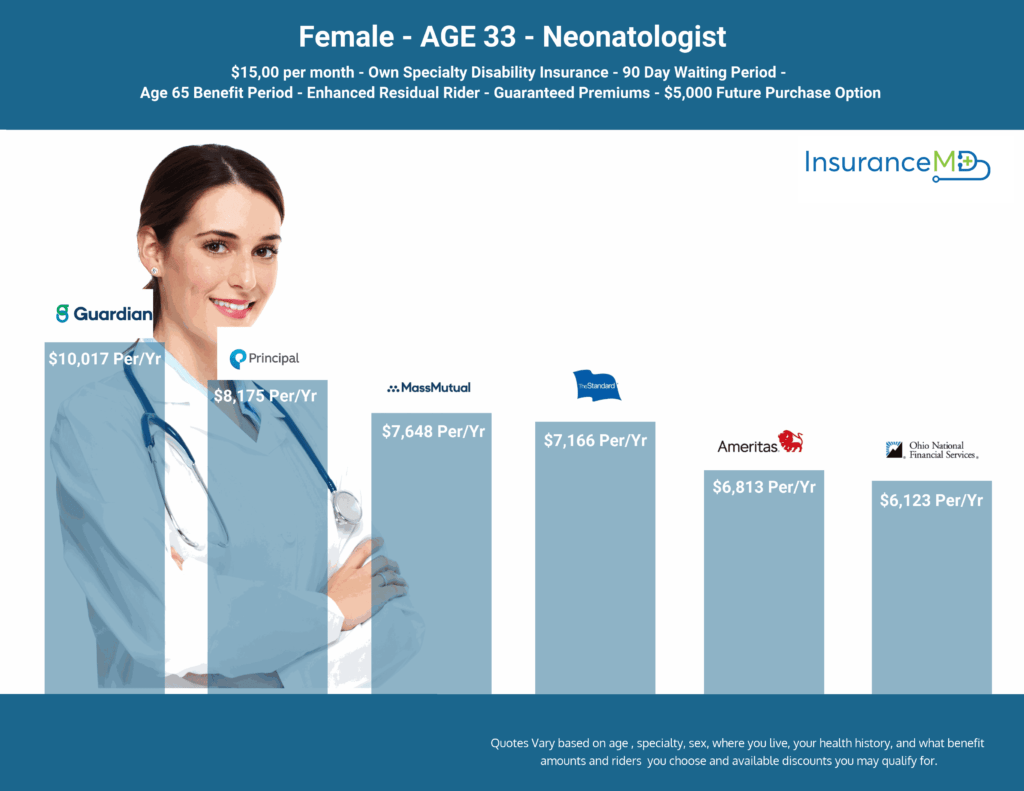

Female- Neonatologist – 33 Years Old – $15,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 65 Benefit Period – Enhanced Residual Rider – $5,000 Future Increase Option – Noncancellable/Guaranteed Renewable

Some Quotes from the Week of February 17th, 2020

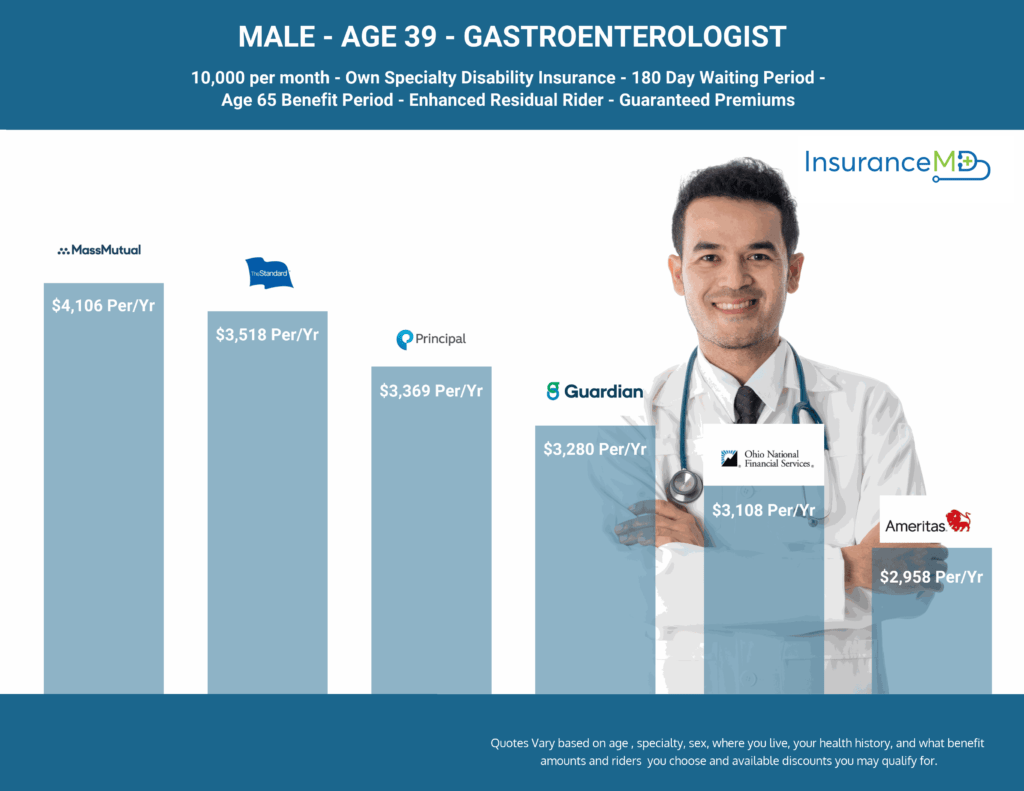

Male Gastroenterologist – 39 Years Old – $10,000 Per Month Own Specialty Benefit – 180 Day Elimination Period –

Age 65 Benefit Period – Enhanced Residual Rider – Noncancellable/Guaranteed Renewable

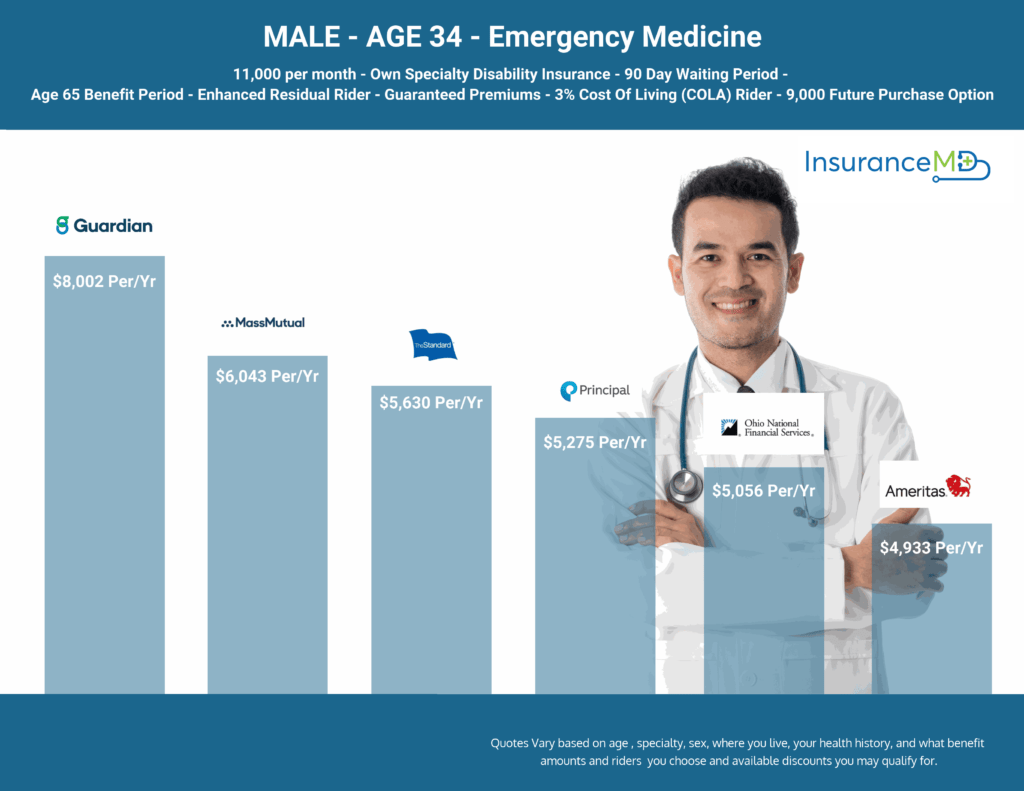

Male Emergency Medicine – 34 Years Old – $11,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 65 Benefit Period – Enhanced Residual Rider – 3% Cost of Living Adjustment Rider – Max Future Increase Option Rider – Noncancellable/Guaranteed Renewable

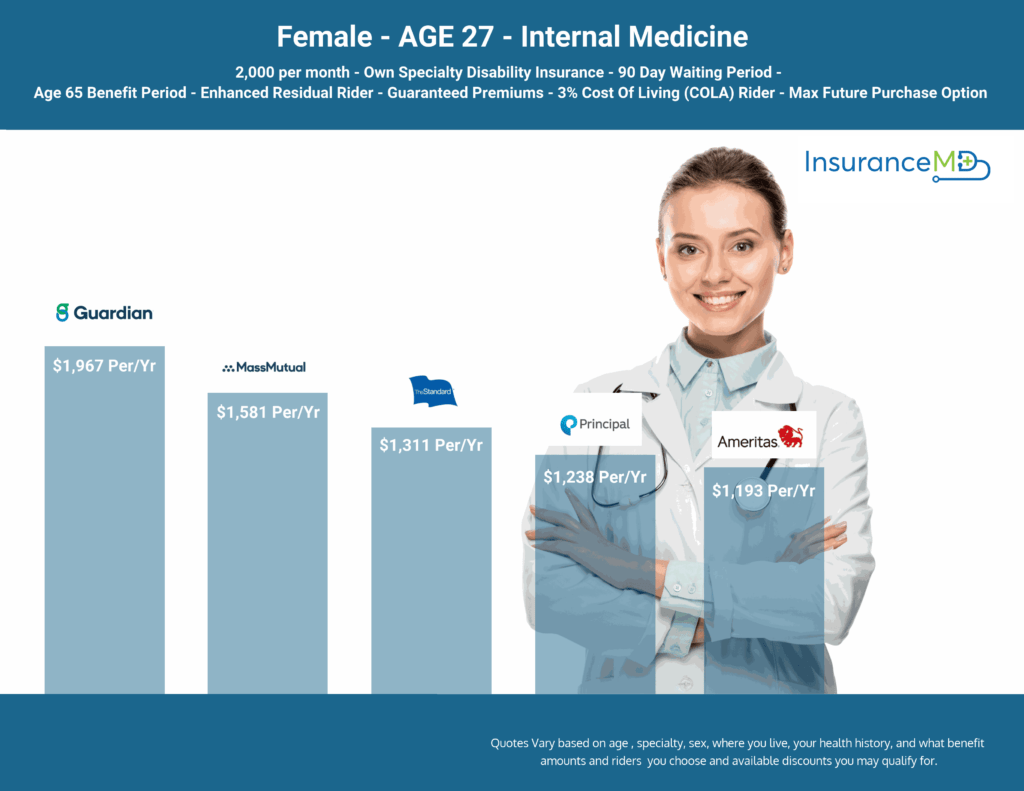

Female Internal Medicine – 27 Years Old – $2,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 65 Benefit Period – Enhanced Residual Rider – 3% Cost of Living Adjustment Rider – Max Future Increase Option Rider – Noncancellable/Guaranteed Renewable

Some Quotes from the Week of February 10th, 2020

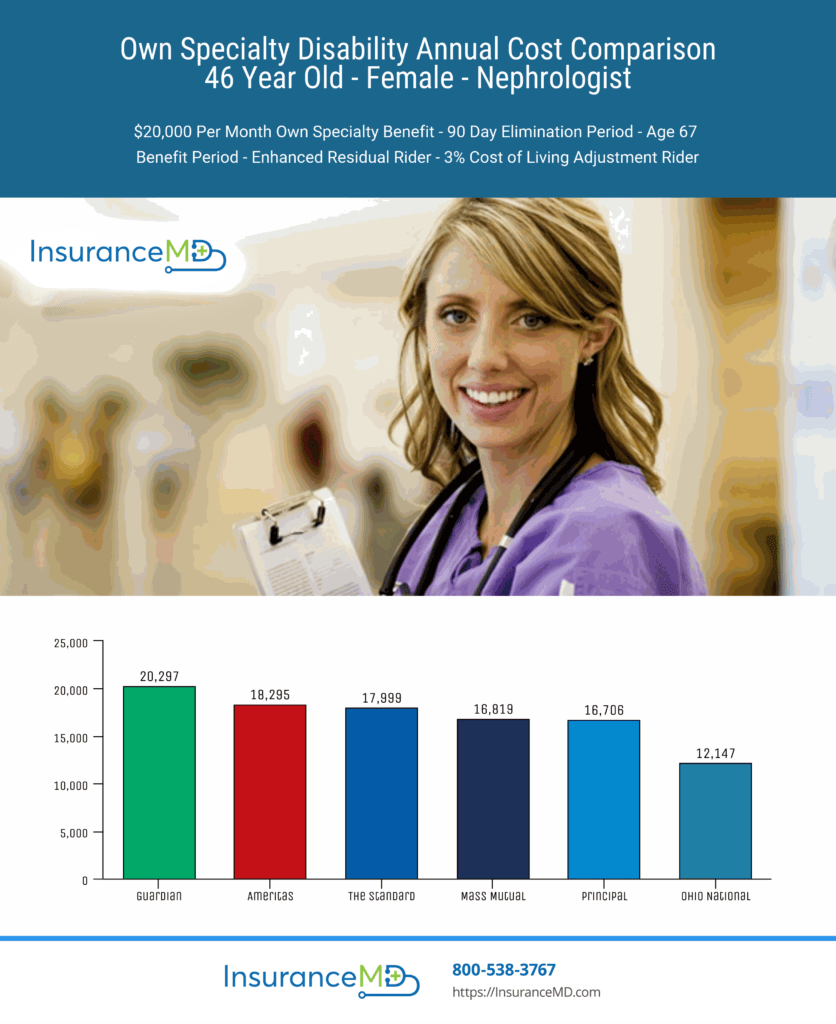

Female Nephrologist – 46 Years Old – $20,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 67 Benefit Period – Enhanced Residual Rider – 3% Cost of Living Adjustment Rider – Noncancellable/Guaranteed Renewable

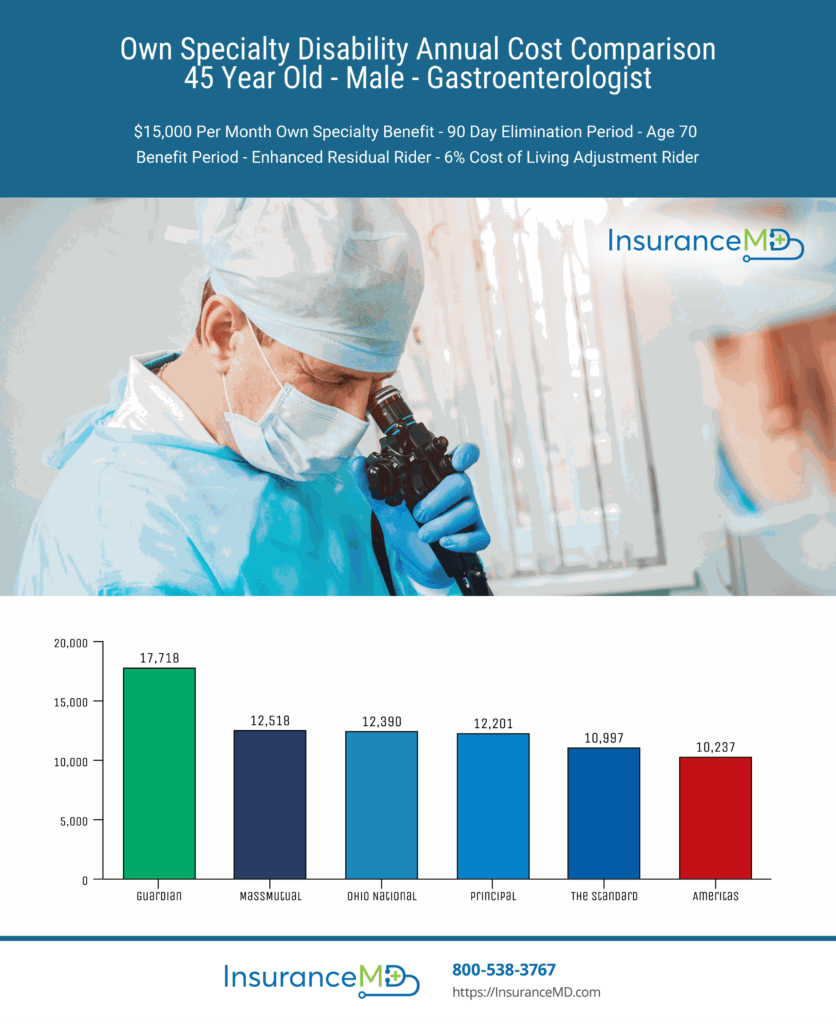

Male Gastroenterologist – 45 Years Old – $15,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 70 Benefit Period – Enhanced Residual Rider – 6% Cost of Living Adjustment Rider – Noncancellable/Guaranteed Renewable

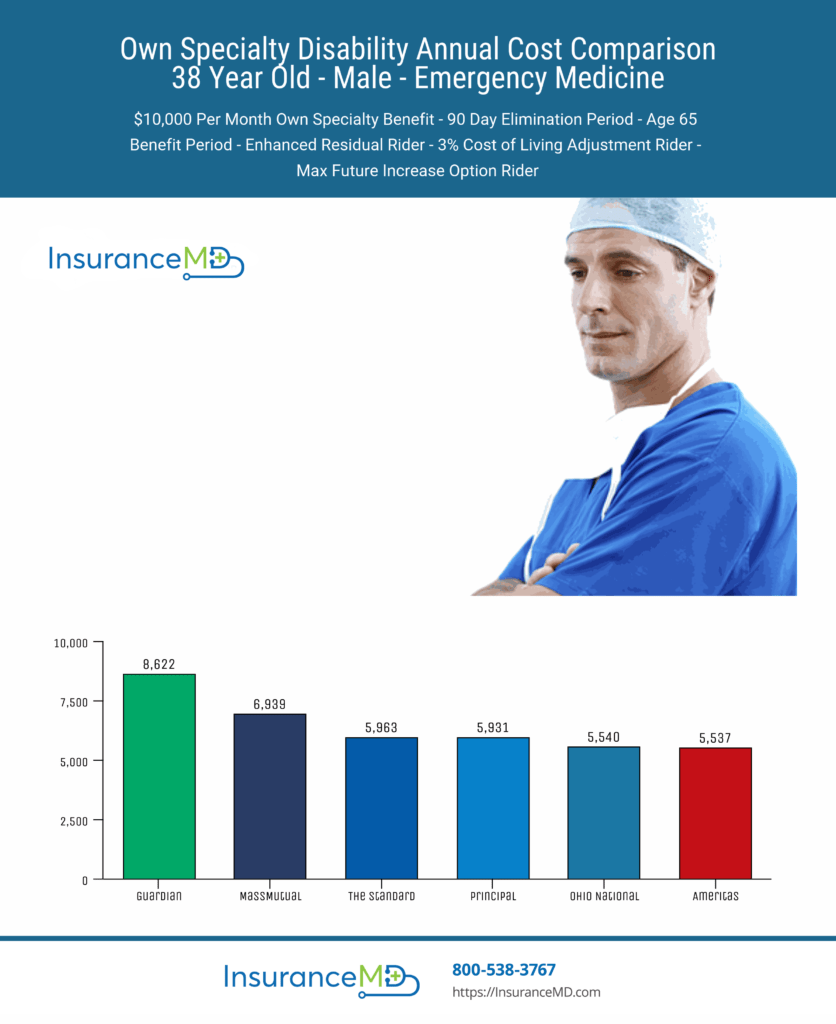

Male Emergency Medicine – 38 Years Old – $10,000 Per Month Own Specialty Benefit – 90 Day Elimination Period – Age 65 Benefit Period – Enhanced Residual Rider – 3% Cost of Living Adjustment Rider –

Max Future Increase Option Rider – Noncancellable/Guaranteed Renewable

Be sure to check back every week to see more quotes we’ve sent to physicians looking for Own Specialty Disability Insurance

Want to find out what Own Specialty Disability Insurance will cost you?

Request your quotes today

800-538-3767

800-538-3767